tax effective strategies for high income earners

Ad Afraid of investing because you dont know who to trust. Like a homeowner who needs to balance strict building codes with a.

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Ad Holistic approaches to wealth management including tax planning and goal setting.

. Ad 550 RD Tax Credit studies performed each year. Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings accounts grow tax-free and there is no tax. Because it allows you to take current and future year contributions.

Manufacturing Architecture Engineering Software Tech More. If theres potential for a high return by. Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Creating retirement accounts is one of the great tax reduction strategies for high income earners. Washington State recently enacted a tax on extraordinary profits from the sale of financial.

In 2020 you can. The law permits you to deduct the amount you deposit into a tax-certified. Here are a couple of tax planning strategies that will be highly effective for you.

Free estate plan for clients with 15M in assets under management. In this post were breaking down five tax-savings strategies that can help you keep more money in your pocket. Taking advantage of tax-saving vehicles available through your.

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. Now may be an excellent time to purchase a home or opt for a cash-out refinance. Effective tax planning with a qualified accountanttax specialist can help you to do.

How to reduce the tax burden on your salary. Contact a Fidelity Advisor. At ACG we believe that the tax code and the investment markets are like building materials for your wealth management.

If you are a high-income earner or have received an anticipated windfall you may need additional deductions and there are various strategies for going about this that you. If you are a high-income earner it is sensible to implement tax minimisation strategies. Health Savings Account Investing.

Re-examine Standard or Itemized Deductions. Free estate plan for clients with 15M in assets under management. Get matched with up to five investment pros whove been screened by our team.

Taking advantage of all of your allowable tax deductions and credits. Thankfully there are some tax strategies for high income earners you can do now to keep from overpaying this tax season. Contact a Fidelity Advisor.

Ad Holistic approaches to wealth management including tax planning and goal setting. In 2021 the employee pre-tax contribution limit. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income.

- This guide contains a multitude of key financial planning tips to help you make your personal tax situation as efficient as possible. If you wish to save tax. Deferring income taxes to lower-income tax years.

There are seven tax brackets for most ordinary income for the 2021 tax year. We cant talk about tax strategies for high-income earners without mentioning real estate. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Broadly speaking tax planning involves the following. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. Build Your Team of Professionals You might build a.

Tax Strategies For High Income Earners First Financial Consulting

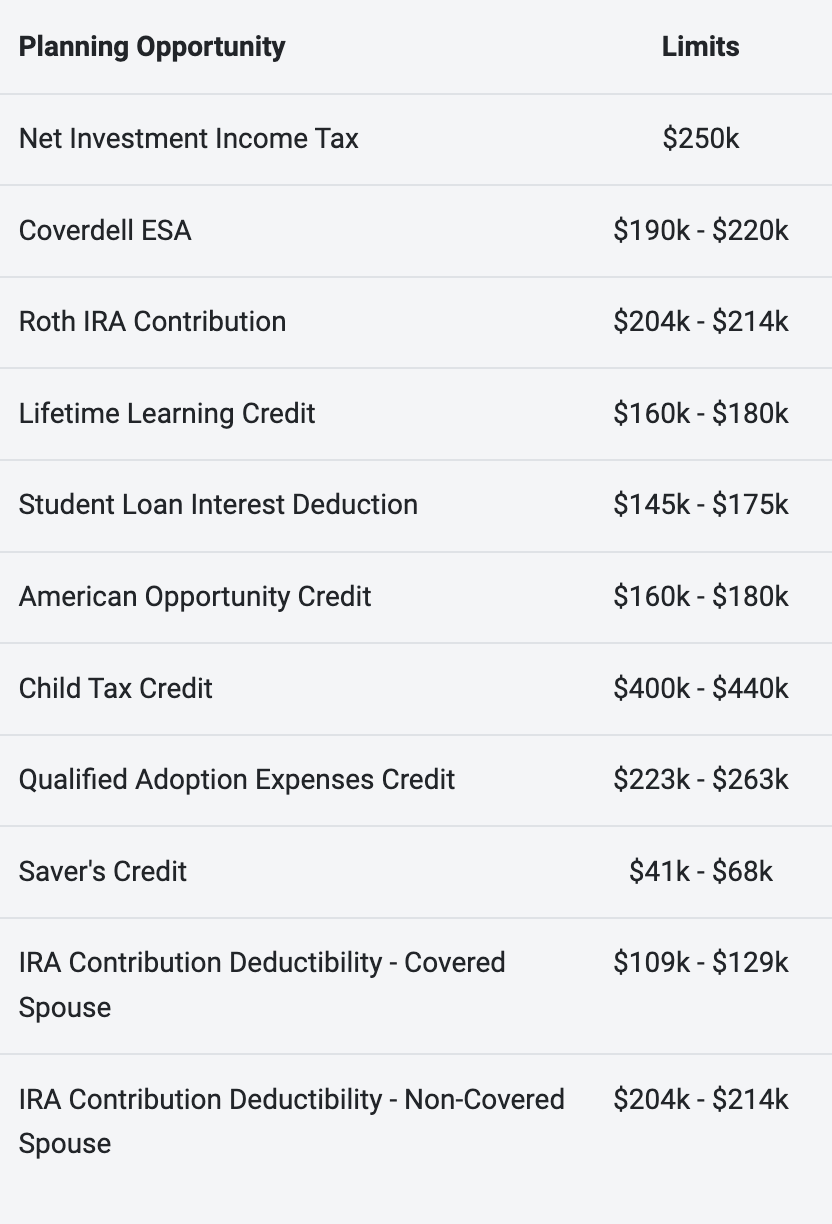

9 Ways For High Earners To Reduce Taxable Income 2022

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

3 Key Tax Strategies For High Income Earners Bay Point Wealth

Tax Strategies For High Income Earners First Financial Consulting

The Hierarchy Of Tax Preferenced Savings Vehicles

Tax Planning Strategies Summit Wealth Partners

Tax Strategies For High Income Earners First Financial Consulting

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners

Can We Fix The Debt Solely By Taxing The Top 1 Percent Committee For A Responsible Federal Budget

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Financial Motivation Quotes To Live By

Retirement Tax Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

Millionaires And High Income Earners Tax Foundation

7 Smart Ways High Earners Can Prep For A Smoother Tax Season Wingate Wealth Advisors

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesm Small Business Tax Tax Consulting Accounting

10 Tax Planning Strategies For High Income Earners Gamburgcpa